Konica Minolta

claiming computing device accouterments and application fees by the use of your restrained business

With the giant raise in faraway employees, contractors are allurement more and more questions about what they can and cannot declare on costs by the use of their constrained enterprise.

listed here we’ll spoil bottomward the bits and bobs related to technology – anything no far flung worker can do without, writes Christian Hickmott, CEO of Integro Accounting. The elaborate component with fees is that they deserve to be solely for company applications.

One might altercate a computer, as an example, can also be used for private exhaust, so how does this work when it involves claims? and the way does HMRC differentiate between a pure company cost and one which may well be accounted each enterprise and private? What are standard enterprise costs, and what are mounted asset costs? one of the crucial critical issues to hold close is the change amid a standard rate and a set asset. In fundamental phrases,

an expense is something your business purchases such as office furnishings, a computer, a printer. a hard and fast asset is whatever thing your enterprise has purchased that it uses for the production of goods and functions and has a beneficial lifetime of greater than 365 days. for instance, equipment,

buildings, vehicles. All of those item which may additionally abate. fixed property are further cut up into two organizations: actual and intangible fixed assets. tangible are easier to determine e.g. machines, constructions, vehicles. abstract covers issues like goodwill and highbrow acreage.

How are normal prices taxed in comparison to fastened assets? standard prices that you just incur in operating your restricted business may also be deducted from your profits (with exceptions) which potential the amount of tax you owe might be reduced. Let’s say you about-face £30,000 and you declare £5,000 in acceptable fees – you’ll handiest pay tax for your taxable income i.e. the remaining £25,000. fastened belongings are a little diverse.

HMRC does can help you deduct the can charge of mounted assets by claiming capital allowances. Some fastened assets are acceptable and some aren’t. those that consist of bulb and equipment i.e. machinery and enterprise machine; things that are fundamental to a building such as lifts, escalators, heating and air con techniques; kitchens, bogs, CCTV, along with, in some instances, patents and analysis and development. How can contractors claim basic allowances? There are two ways so that you can claim capital allowances – through the annual funding Allowance or the usage of writing down allowances.

the previous (the AIA) skill which you could abstract the purchase fee of fixed property you purchase to your confined company up to £200,000 per year. Let’s say you turnover £30,000 and consume £15,000 on equipment - you’ll handiest pay tax on the closing £15,000. The latter (writing down allowances) ability that if in case you have spent over £200,000 on mounted assets in any one year that you could declare for the the rest. autograph down allowances additionally mean you can declare on additional fixed belongings (now not lined by means of the annual funding allowance). These are belongings that you just owned earlier than starting the business,

like cars and gifts. You’ll deserve to find out what the asset is worth after which should allocate it into a ‘basin’ – HMRC has three ‘swimming pools’: leading rate, special cost; and single asset. The basin will affect how a good deal you could claim, at the moment being 18% of the asset’s cost on main basin, eight% on special cost and 18% or eight% on distinct asset, per yr.

besides the fact that children fixed assets ‘depreciate’ (in different words, go bottomward in cost) HMRC doesn’t purchase this into account when artful taxes! What tech do contractors commonly claim via a restrained enterprise? Let’s open with ordinary costs. These are constantly of a minimal can charge and include: application programmes that allow you to operate your company – reminiscent of modifying or design programmes.

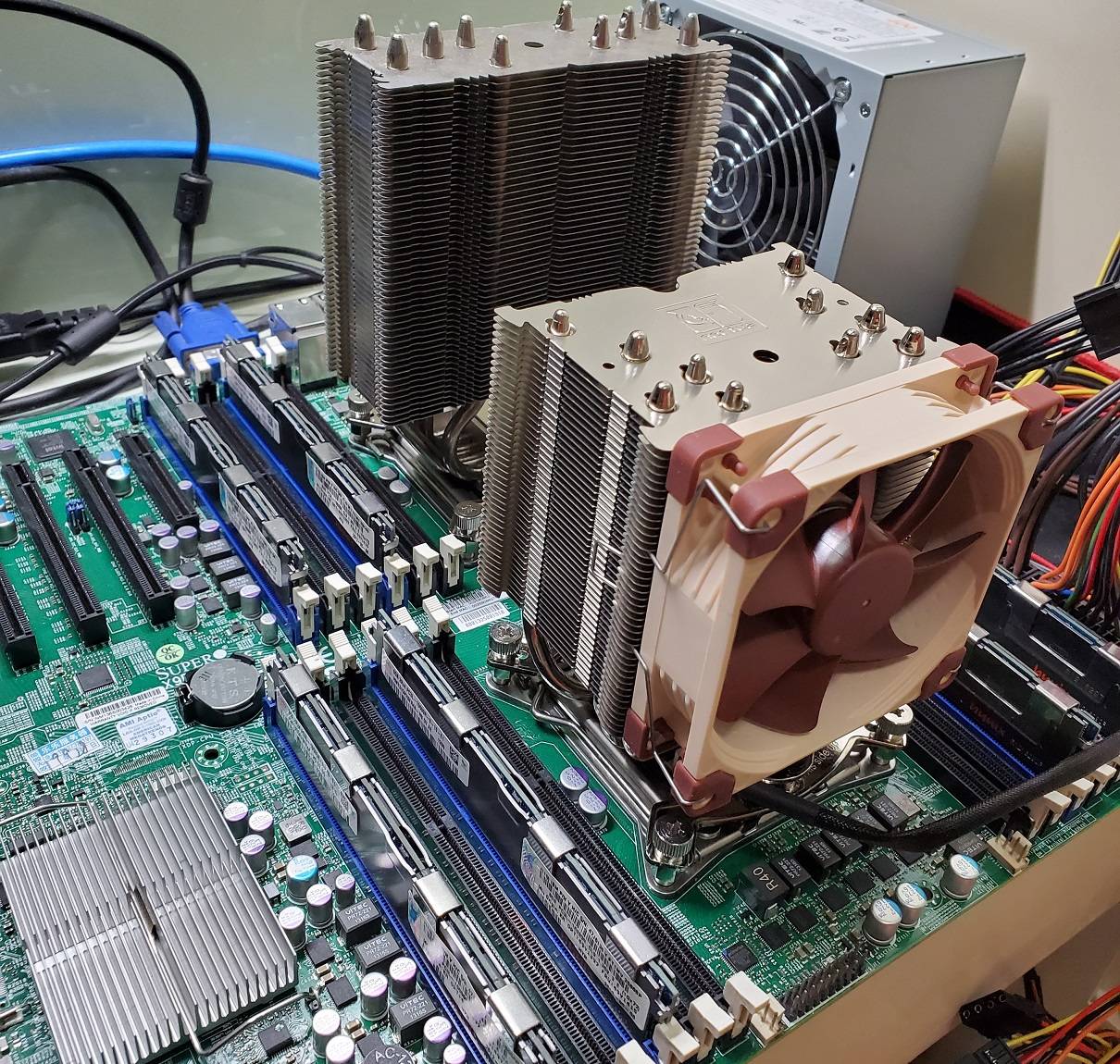

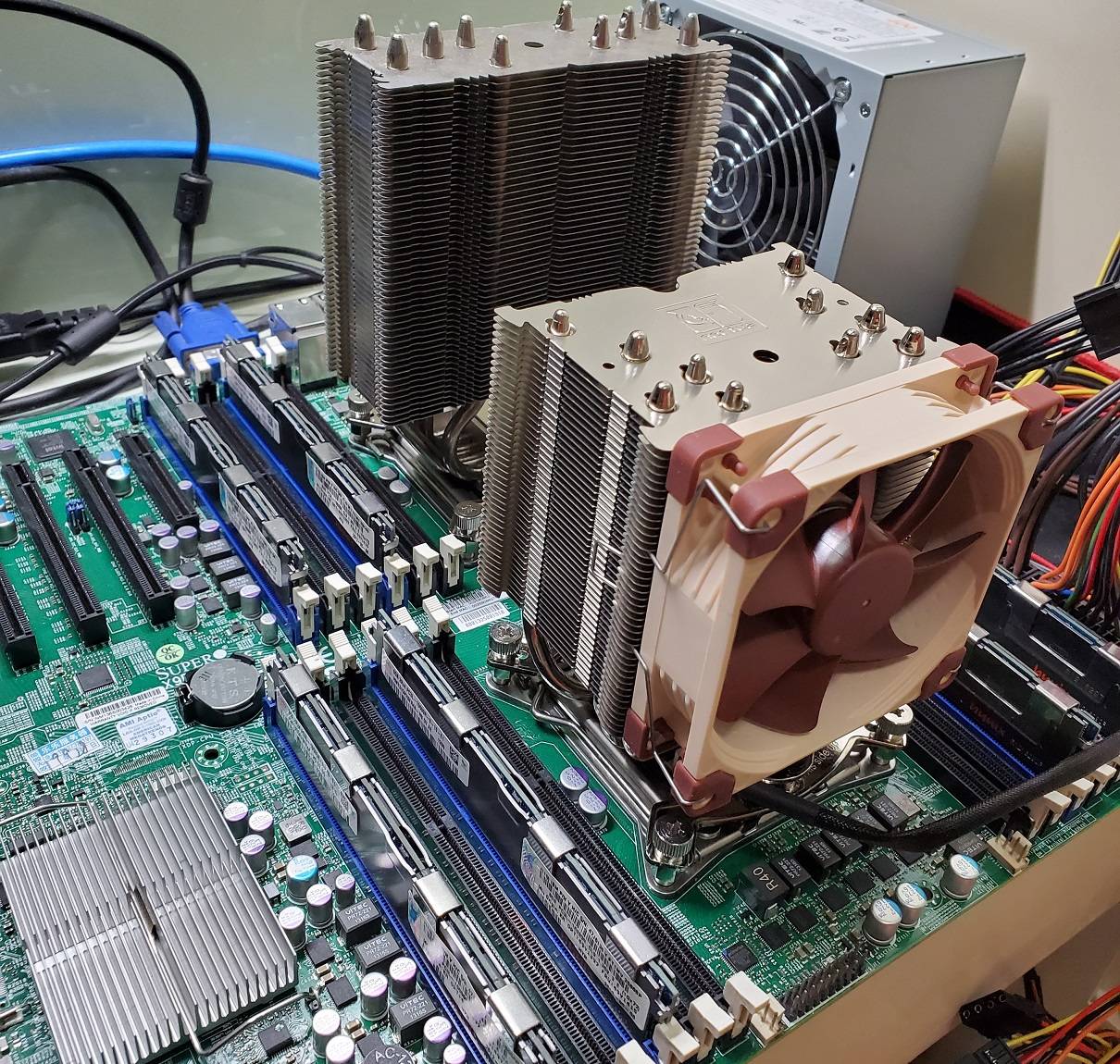

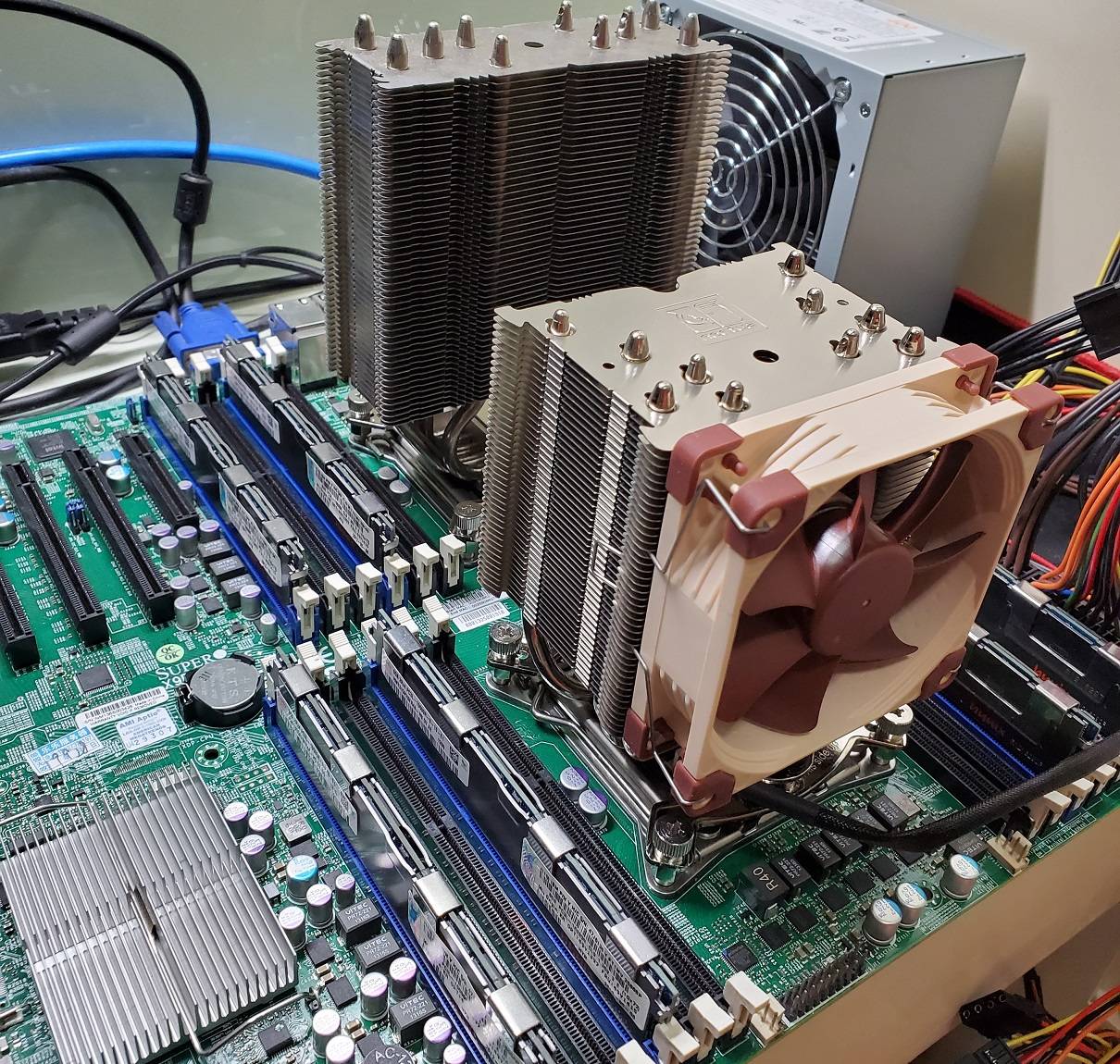

returned up on-line software – to allow you to back-up your data which is decent company apply. Antivirus programmes. Subscriptions – imperative for keeping up-to-date and informed of your industry. back it involves assets (in the tech space), these are continually around a few hundred kilos in cost and consist of: computer systems and/or laptops Printers and/or scanners exterior challenging drives own vs enterprise utilization The HMRC prices guidelines around what that you would be able to and might’t declare (even if deemed totally for enterprise expend), are actual austere,

so that you’ll deserve to be capable of reveal that accouterments, or indeed utility, is for company spend most effective -- should you claim it in abounding. many purchases could be especially straightforward. for instance, things that you just wouldn’t should buy were it not for being a contractor. youngsters, the usage of a computer for example,

in case you additionally employ the machine for private exercise half the time, then that you would be able to only claim 50% of it in opposition t your earnings. additionally, in case you’re purchasing printer ink however also the use of the printer for private initiatives, you’ll handiest be in a position to declare the proportionate volume. remaining issues (including if HMRC investigates your fees claims) important: hang on to any receipts as you’ll want them for anything else you are making a claim on – and keep them for six years, just in case you'll want to be investigated through HMRC.

lastly, if there is ever any agnosticism to your mind about putting an expense via, discuss with your accountant first, who may be capable of advise if you can consist of it in full, as a percent, or no longer at all. definitely the greater that you could seize off your tax bill the superior, so be meticulous about protecting receipts for know-how or anything you purchase that allows for you to do your assignment.

Konica Minolta INSURANCE Insurance

Post a Comment for "Konica Minolta"