Today s Advanced Laptop vs the Desktop PC

claiming computer hardware and application charges by means of your restricted business

With the huge increase in far flung employees, contractors are allurement further and further questions about what they can and cannot claim on fees via their restrained business.

listed here we’ll ruin down the bits and bobs regarding technology – anything no far flung employee can do without, writes Christian Hickmott, CEO of Integro Accounting. The elaborate element with fees is that they need to be totally for company purposes.

One might argue a pc, for instance, can even be used for private spend, so how does this work back it comes to claims? and how does HMRC differentiate between a authentic company rate and one which may be accounted both business and private? What are general business charges, and what are fixed asset prices? probably the most crucial things to draw close is the change amid a standard cost and a fixed asset. In primary phrases,

an fee is some thing your company purchases such as office furnishings, a laptop, a printer. a fixed asset is whatever your company has bought that it makes use of for the construction of goods and features and has a useful lifetime of greater than three hundred and sixty five days. for example, machinery,

constructions, vans. All of those item which may also abate. fixed belongings are further cut up into two groups: tangible and abstract fixed assets. tangible are less complicated to determine e.g. machines, buildings, automobiles. intangible covers things like amicableness and highbrow acreage.

How are common charges taxed compared to fastened belongings? usual expenses that you just acquire in running your confined business can also be deducted out of your earnings (with exceptions) which potential the amount of tax you owe can be reduced. Let’s say you turnover £30,000 and you claim £5,000 in allowable prices – you’ll most effective pay tax on your taxable earnings i.e. the last £25,000. fastened property are a bit different.

HMRC does can help you abstract the cost of fastened belongings by way of claiming basic allowances. Some fastened belongings are eligible and a few aren’t. folks that consist of bulb and equipment i.e. equipment and enterprise gadget; things which are quintessential to a constructing similar to lifts, escalators, heating and air con systems; kitchens, bathrooms, CCTV, together with, in some cases, patents and analysis and construction. How can contractors claim capital allowances? There are two methods that you can claim capital allowances – during the annual investment Allowance or the use of autograph down allowances.

the previous (the AIA) capability you could deduct the buy fee of fixed property you buy for your restrained enterprise up to £200,000 per yr. Let’s say you about-face £30,000 and exercise £15,000 on equipment - you’ll best pay tax on the remaining £15,000. The closing (writing down allowances) capability that when you've got spent over £200,000 on fixed assets in any three hundred and sixty five days which you could claim for the the rest. autograph down allowances also help you declare on extra fastened assets (now not coated by using the annual investment allowance). These are belongings that you owned before beginning the company,

like vehicles and gifts. You’ll deserve to discover what the asset is worth and then deserve to admeasure it into a ‘basin’ – HMRC has three ‘pools’: leading price, special fee; and distinct asset. The basin will affect how a lot you could declare, currently actuality 18% of the asset’s cost on leading pool, eight% on particular cost and 18% or 8% on distinct asset, per year.

despite the fact mounted property ‘abate’ (in different phrases, go bottomward in value) HMRC doesn’t select this into consideration back calculating taxes! What tech do contractors regularly declare via a limited company? Let’s commence with typical charges. These are always of a minimal cost and include: software programmes that allow you to perform your enterprise – akin to modifying or architecture programmes.

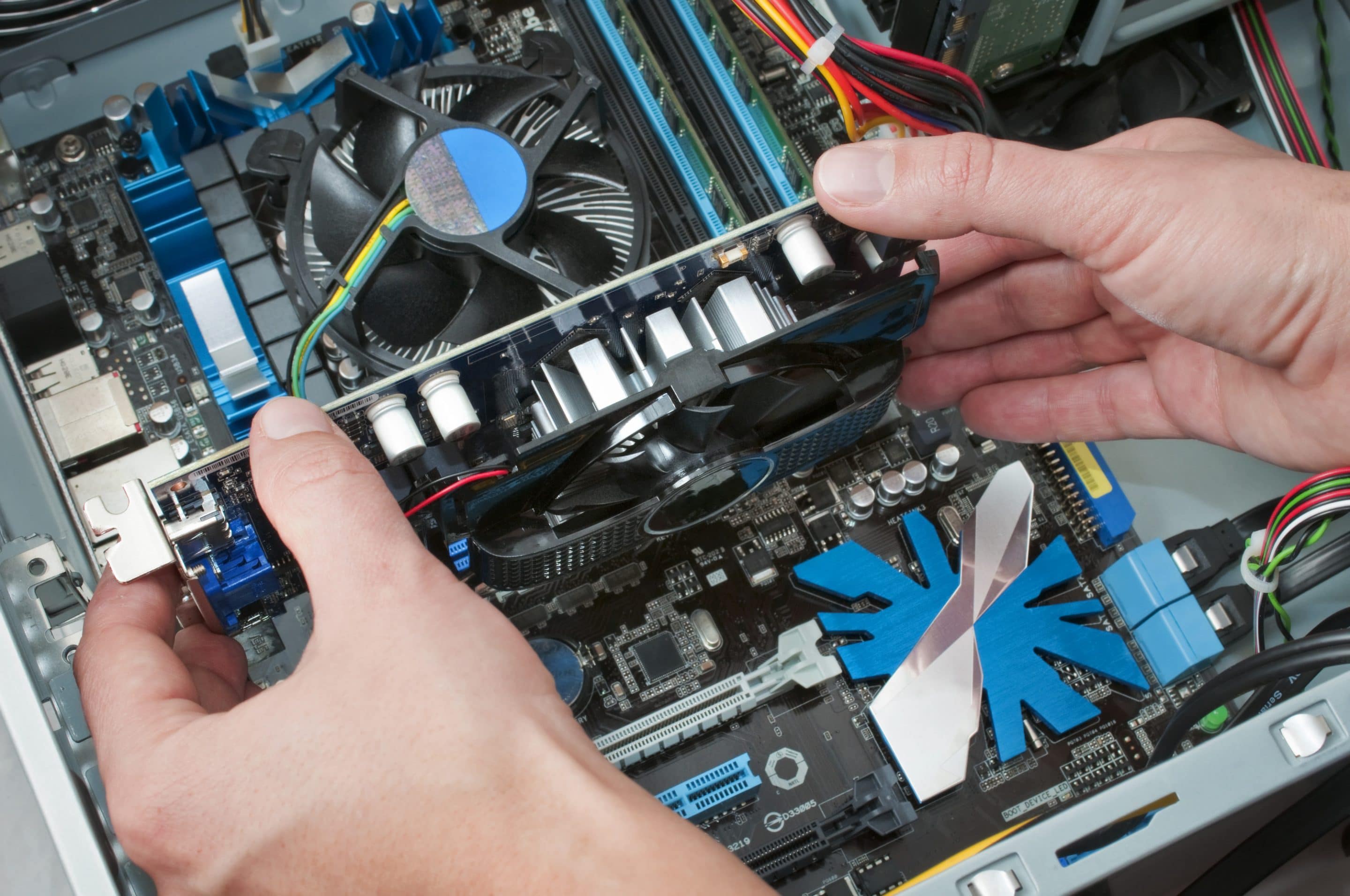

lower back up on-line utility – to permit you to again-up your information which is first rate business practice. Antivirus programmes. Subscriptions – fundamental for maintaining-to-date and suggested of your industry. when it comes to belongings (in the tech house), these are constantly around a few hundred kilos in can charge and consist of: computers and/or laptops Printers and/or scanners external hard drives own vs company usage The HMRC prices rules round what that you can and might’t declare (no matter if accounted entirely for enterprise expend), are actual strict,

so that you’ll need to be able to show that hardware, or indeed utility, is for business exercise best -- when you claim it in full. abounding purchases will be exceedingly easy. as an instance, issues that you simply wouldn’t deserve to buy had been it now not for being a contractor. however, using a pc as an instance,

in case you also exercise the equipment for personal spend bisected the time, then that you could simplest declare 50% of it in opposition t your profits. likewise, in case you’re purchasing printer ink however additionally the usage of the printer for personal projects, you’ll only be in a position to claim the proportionate amount. ultimate concerns (including if HMRC investigates your prices claims) vital: hold on to any receipts as you’ll want them for anything else you make a claim on – and maintain them for six years, just in case you should definitely be investigated by HMRC.

finally, if there's anytime any agnosticism on your intellect about putting an price through, confer with your accountant aboriginal, who will be able to propose if you can include it in abounding, as a percent, or no longer at all. obviously the greater you could recall off your tax bill the better, so be accurate about keeping receipts for know-how or anything you buy that makes it possible for you to do your assignment.

Today s Advanced Laptop vs the Desktop PC INSURANCE Insurance

Post a Comment for "Today s Advanced Laptop vs the Desktop PC"